Have home prices come down?

Here is a very specific example.

Tale of 2 Bungalows….

Both built in 1990

Same area: 3 Doors away from each other same side of the street.

Central Whitby.

Lot size identical

Ravine Lot

Finished Walk out basement

2 car garage

Relatively same level of current renovations

First Example: Recent Sale

3+1 Bed. 2+1 Bath

Finished Walk out basement

Backs onto Ravine

Sold in June 2025 for $865k

Second example:

3+2 Bath

3 Bath

Finished Walk out basement

Kitchen in basement

Backs onto Ravine

Sold in April 2023 for $1.2 Million

That’s a $335,000 dollar difference in 25 Months!

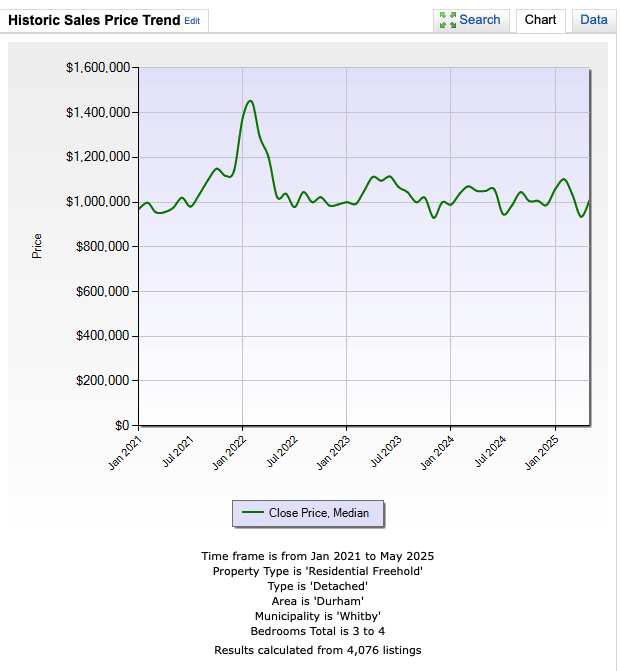

I have attached a chart showing price trend since January 2023.

This shows we are basically at Early 2021 prices NOW.

The COVID Bump is long gone.

What are the current factors affecting Real Estate?

Interest Rates:

The current Prime Rate is 4.95%

Current rates I have seen are 3.85% to 4.65% depending on the situation.

During COVID Rates were as low as the 1.5% to 2% range. Let’s be honest and clear about this… There will never be rates that low again… unless of course we are in serious trouble economically. We will however see variable rates drop later this year and into next year as the government continues to ease depending of course on the overall economy.

Affordability: We have shown below that affordability is back to a 2021 range. Unfortunately with the current housing climate and the primary factor of supply and demand we may not see pricing drop much farther. There is a lack of motivation for builders to construct new projects due to their inability to be profitable. Whether the government will be able to make changes to development fees and other contributing factors only time will tell. Having head from builders that this is the main driving factor behind the tendency to not start new projects we need governments to work together to remedy this.

In the end we need to realize that a home is a commodity with a supplier and end user. Standard business theories apply.

Real Estate Investment: In my opinion this has been a major factor in the increase of prices in the larger centres in Canada due to the frenzy of amateur investors buying up property. Mostly in the Condo sector we have seen as the majority of units sold to those who wish to either flip them prior to occupancy or within a year of occupancy. As we saw interest rates climb and as a result rents we saw this trend collapse. AirBNB was a strong driver of this trend as individuals expected to make huge profits. This too has come full circle with most Condos in Toronto outlawing short term rental along with the municipalities. More recently we have seen some individuals who are in serious trouble as their investment properties appraised values not keeping in line with what they paid for the property. This has resulted in a 30% default rate in some new home sectors. The future of Real Estate Investment? Buy and Hold… as it always was. Cash Flow? When will it be possible again in the GTA?

So where does that leave us?

We are seeing sight price declines but more importantly steep declines in unit sales causing what I call a Stalled Market.. Not a buyers market as many will call it.

What are you thoughts?

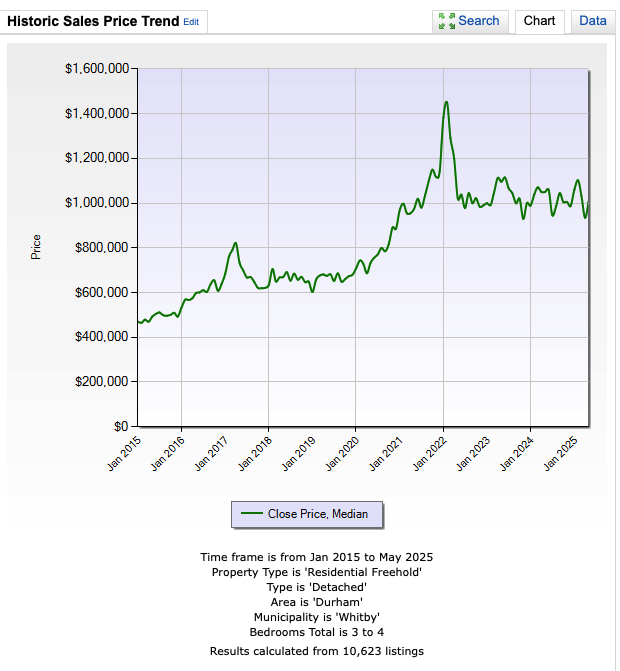

Longer View: